Introduction

Landing your first full-time job in the U.S. is a milestone—a reward for years of study, internships and hustle. But once that first paycheck hits, the real work begins: turning that salary into a foundation—not just for spending but for saving, building, and securing your future. That’s why understanding your first-time job salary in the US and knowing what you must set aside before it’s too late is crucial.

In this post, we’ll explore realistic starting pay-levels, the must-set-aside slices of your salary (yes, even for your first job), how to craft a budget that honours your present and your future, and what happens if you don’t take action. The tone is conversational because you’re more than a number—you’re starting a life. And you deserve guidance that feels human, relatable and practical.

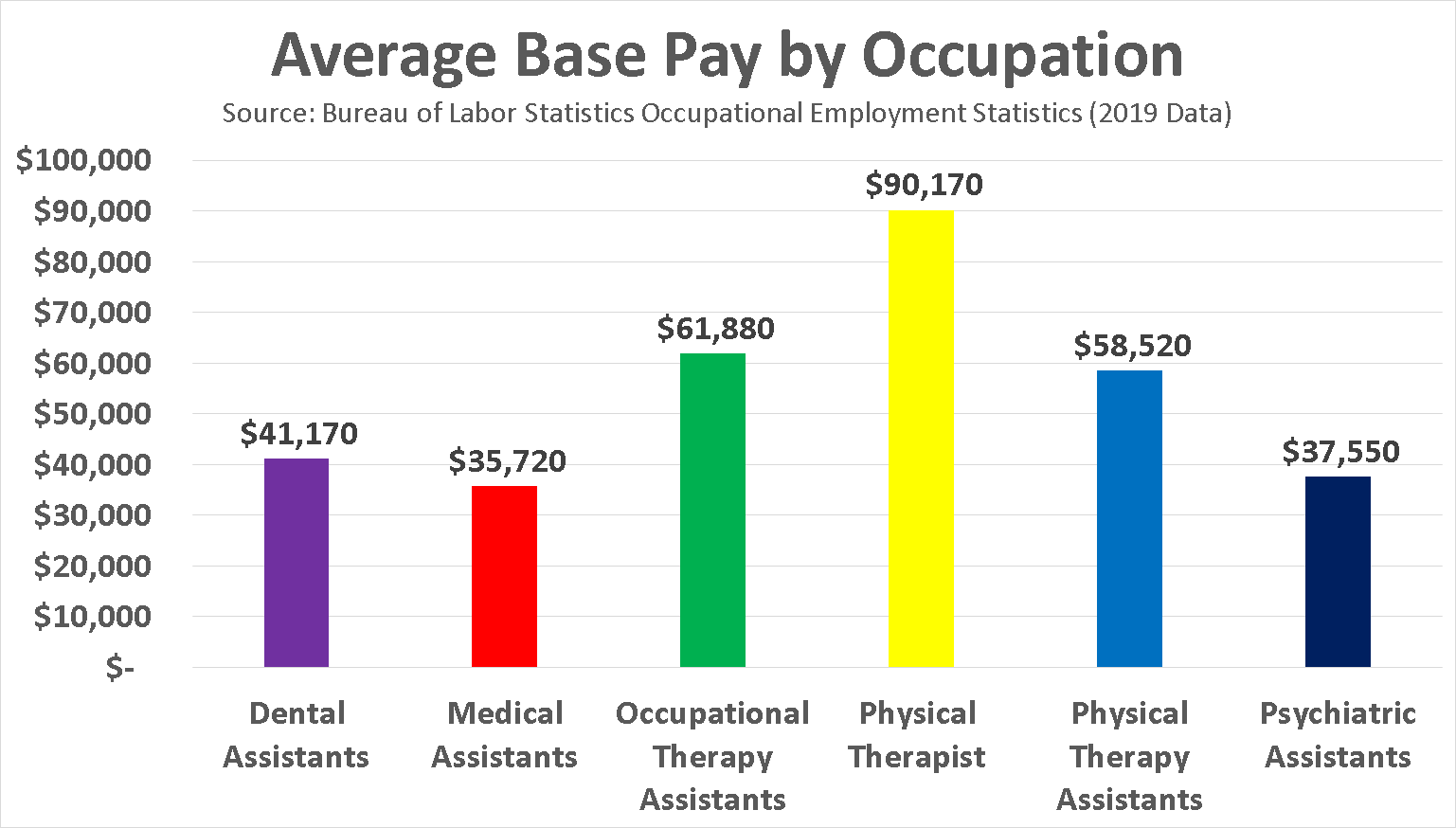

What is the typical first-time job salary in the US?

Before we talk about what to set aside, let’s ground ourselves in what many new professionals actually earn.

- According to the National Association of Colleges and Employers (NACE), the average starting salary for college graduates in 2025 is projected at roughly $68,680. (SoFi)

- That said, “entry-level salary” across all sectors (including non-college-grad roles) is much lower. For example, a report by Indeed notes average base salary for entry-level U.S. jobs at ~$43,262. (Indeed)

- Location, major/industry, skills and cost of living vary the pay widely. A 2025 figure shows average U.S. salary across all workers at ~$62,192 annually. (DemandSage)

So, if you’re just starting full-time after college you might reasonably expect somewhere between $45,000-$70,000 depending on your role and location.

Why you must set aside parts of your first-time job salary in the US before it’s too late

Getting paid is exciting. But failing to allocate parts of your first paycheck thoughtfully can lead to missed opportunities, financial stress and slower wealth growth. Here’s why setting aside now matters:

- Time is on your side: The earlier you save/invest, the more years your money has to grow.

- Habit formation: The habits you build now (saving, allocating, resisting lifestyle inflation) become your default.

- Risk mitigation: Even new jobs can face shocks—job changes, moves, unexpected expenses. Having something saved protects you.

- Opportunity cost: Money spent now on wants or unchecked lifestyle upgrades is money that could’ve been building your future.

- Budget under pressure: Entry salaries may feel tight, but leaning disciplined early means you avoid crunch later.

In short: treat your first-time job salary as both reward and responsibility.

How much of your first-time job salary in the US should you set aside?

Let’s talk numbers. Here are practical steps and a comparison for what to allocate.

Must-set-aside buckets

Here are the key slices you should allocate from your gross or net salary early:

- Emergency fund contribution: Even $50-$100/month adds up.

- Retirement/investment savings: If your employer offers 401(k) match or you have an IRA, begin contributing.

- Debt repayment (if applicable): Student loans, credit cards, anything carrying interest.

- Taxes and benefits cushion: If you’re new to full-time work you’ll have higher tax withholding/benefit deductions—set aside to avoid surprises.

- Future-you savings: Big goals (home, travel, education) may sit later, but begin saving a small amount.

Comparison Table: What to set aside vs what typical new salary allows

Here’s a table to illustrate how this could look assuming an entry salary of $55,000/year (approx $4,583/month before taxes). Adjust depending on your salary.

| Salary ~$55,000/year | Suggested Allocation | Approx Amount |

|---|---|---|

| Gross/monthly | ~$4,583 | |

| Taxes & benefits (estimate) | ~20-25% | ~$900-$1,150 |

| Net monthly | ~$3,433-3,683 | |

| Emergency fund | ~5% of net | ~$170-185/month |

| Retirement/investment | ~10% of net | ~$340-370/month |

| Debt repayment | depends on your debt load | e.g., ~$200/month |

| Discretionary/spending | remainder | ~$2,620-2,873 |

This isn’t rigid — if your salary is higher or lower or you have more debt, adjust accordingly. The key is making allocation real early.

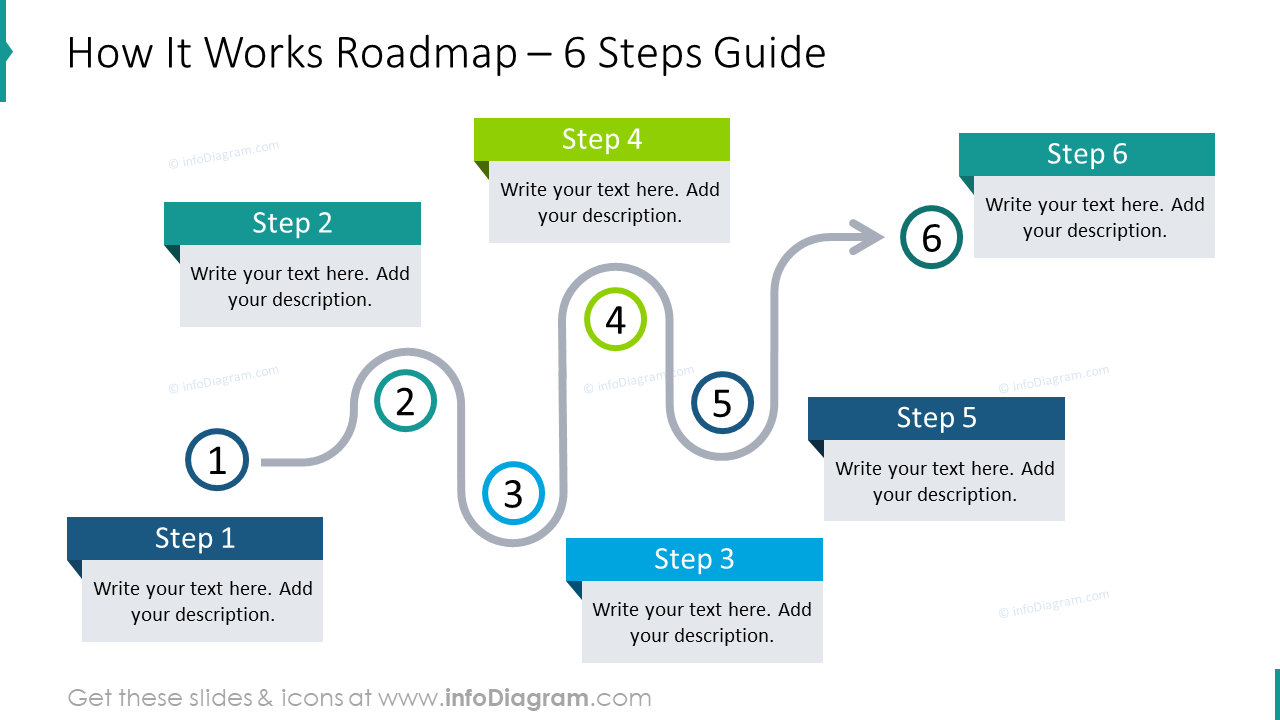

A step-by-step roadmap: what to do with your first-time job salary in the US

Here’s a sequence to follow, so you start smart rather than wing it.

Step 1: Understand your take-home pay

- Confirm your gross salary, expected taxes, benefit deductions. Use your first pay stub as baseline.

- Create a simple budget: income in minus fixed expenses minus set-aside. The remainder is your spending. (See budgeting guide by Bank of America) (Better Money Habits)

Step 2: Automate your set-asides

- Set up automated transfers: e.g., on payday, transfer $X to savings, $Y to retirement/investment.

- Automating means you treat saving as non-optional—it becomes part of your paycheck.

Step 3: Build an emergency fund baseline

- Start small: aim for $500-$1,000 as initial goal. In the first job phase this is realistic.

- Then scale toward 3-6 months of essential living once salary stabilises.

Step 4: Contribute to retirement/investment

- If your employer offers a 401(k) match, contribute at least enough to capture full match—it’s essentially free money.

- If not, begin a Roth IRA or equivalent, even with modest amounts. Your first contributions count more than amount.

Step 5: Manage debt smartly

- If you have student loans, credit-card debt or other high interest debt, allocate a realistic portion of your set-asides to accelerating repayment.

- Avoid new high-interest debt as you grow into your salary.

Step 6: Avoid lifestyle inflation

- One of the biggest dangers: your expenses rise as soon as your pay does. Instead, when you get raises or bonuses, allocate a meaningful portion to savings/investment rather than spending everything. This is especially important in your first job.

- A budget rule like 50/30/20 (needs/wants/savings) can guide you. (Reuters)

Step 7: Review annually or when your salary changes

- When you get your first raise, new bonus or change roles: revisit percentages and set-aside amounts.

- Adjust the table above to your new salary and commit new savings increments.

Common mistakes young professionals make with their first-time job salary

Let’s highlight some pitfalls — so you can avoid them.

- Spending full salary immediately: “Now I earn, I’ll upgrade everything.” Upgrading is fine if you still save.

- Underestimating taxes and deductions: Your first full-time job often means higher federal/state tax and new benefit costs you didn’t have before.

- Not automating savings/investments: Without automation you will default to spending.

- Ignoring retirement because you’re “young”: Time advantage is greatest now—delay costs you.

- Lifestyle creep: As salary rises, expenses creep upward; if savings stay flat you lose momentum.

- Having no budget: You might feel you don’t need one because salary “isn’t huge yet”. But a budget ensures your first-time salary works for you.

Why this matters: Financial impact of setting aside early

- The earlier you invest or save, the more you benefit from compounding.

- Early emergency fund protects you from needing to tap credit at high interest.

- Early retirement contributions mean more years for growth and reduce stress later.

- Building good habits early means your 30s, 40s and beyond are less likely to be dominated by “catch-up”.

A strong first salary decision isn’t just about this year—it sets the tone for your entire financial journey.

What to set aside before it’s too late — wrap-up checklist

Here’s a quick checklist for your first full-time job:

- Know your net pay (take-home) after taxes/benefits.

- Automate at least one savings transfer each payday (emergency fund).

- Set up retirement contributions (401(k) match or IRA).

- Allocate part of salary to debt repayment if applicable.

- Keep your “wants/spending” bucket in check — avoid full upgrade.

- When salary increases, raise your set-aside amounts rather than only spending.

- Review annually: salary, budget, set-aside amounts.

- Track your progress (savings balance, investments, budget adherence).

You may not feel “rich” on your first job salary—and that’s fine. What matters is how you use it. If you treat it wisely, you’ll feel richer later.

Conclusion

Your first-time job salary in the US isn’t just another paycheck—it’s the launchpad for your financial life. What you set aside today has a ripple effect far into your future. By allocating parts of your salary intentionally—emergency fund, retirement, debt repayment—and automating that process, you make your future self much stronger.

Don’t wait until you feel “ready” or “earn a lot more”. This is precisely the time to build good habits, even if the amounts are modest. Because what might look like a small percentage now becomes huge leverage later.

So here’s your prompt: The moment you receive your first full pay-slip, take one small action: schedule that savings transfer, set retirement contribution, adjust your budget. That action marks a shift—from being paid, to being paid-for tomorrow.

Your first salary is important; how you use it makes it powerful. Make it count.